MINERA ALAMOS ANNOUNCES ACQUISITION OF SABRE GOLD

Copperstone adds additional near-term production potential to existing growth profile

Toronto, Canada (October 28, 2024) – Minera Alamos Inc. (TSXV: MAI; OTCQX:MAIFF) ("Minera Alamos") and Sabre Gold Mines Corp. (TSX: SGLD; OTCQB: SGLDF) ("Sabre Gold") are pleased to announce that they have entered into a definitive agreement, signed on October 27th, 2024, (the "Agreement") whereby Minera Alamos will acquire all of the issued and outstanding shares of Sabre Gold ("Sabre Gold Shares") pursuant to a plan of arrangement (the "Transaction"), further enhancing Minera Alamos’ position as a growth oriented gold producer.

Transaction Highlights

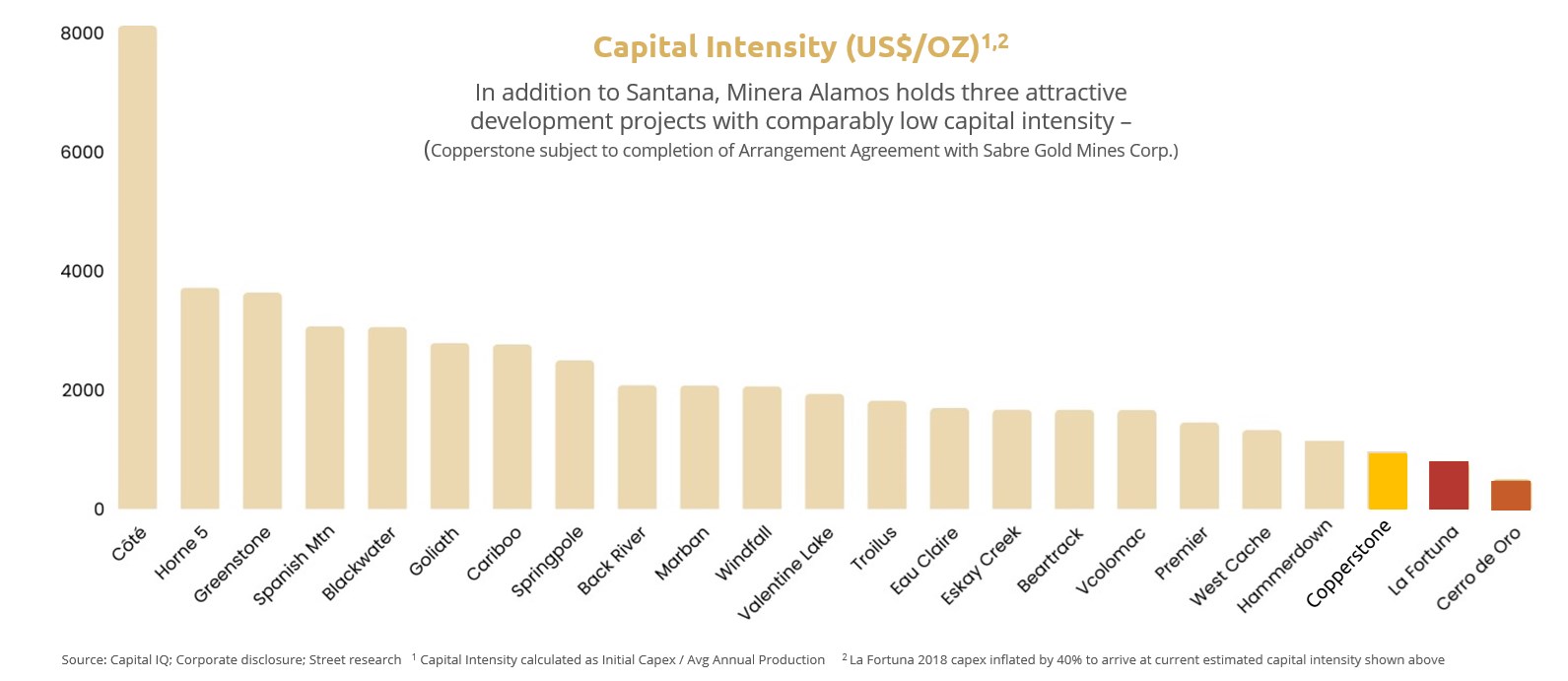

- Creation of a Diversified North American Gold Producer Platform – Beyond the Santana gold mine operations (Sonora, Mexico), the addition of Copperstone (Arizona, US) helps provide visibility to a further 150koz of annual gold production in premier mining jurisdictions in North America

- Acquisition of Past Producing Copperstone Mine – Sabre’s flagship asset produced a total of 514,000 oz of gold from 1987 to 1993. Along with existing infrastructure, the project contains significant additional resource ounces and is at advanced stage permitting for a near-term mine restart (see PEA details that follow)

- Accelerating Copperstone Back into Production – Minera Alamos’ in-house mine-building expertise combined with Minera’s previously acquired process plant equipment will allow for significant reductions in capital costs and operation restart times in this very strong gold price environment

- Transaction supported by Sabre Creditors – Elimination of approximately $9.4 million of existing debt at a 15% discount to face value.

Darren Koningen, CEO of Minera Alamos, stated: “The Copperstone project is an ideal addition to our portfolio of low capex, late-stage development projects. The site has significant infrastructure and permits in place which will allow our technical group to quickly advance the project into production. We have already initiated our engineering efforts aimed at fast-tracking Copperstone’s development and are working to expand our technical team under the guidance of Kevin Small, a director with Minera. Recently, as President of Sprott’s Jerritt Canyon undergound operations in Nevada, Kevin led the project turnaround prior to its sale and he has extensive underground mining experience both in Canada and the southwestern US. We are also in discussions with lenders in connection with potentially expanding existing finance facilities to accommodate the development of both Copperstone as well as our Cerro de Oro project in Mexico, which is awaiting permit approvals. This merger is a great example of how complementary assets can be combined to de-risk and scale up a development platform simultaneously.”

Andrew Elinesky, President and CEO of Sabre Gold, stated: “Minera Alamos is an ideal partner for Sabre Gold given their extensive experience in planning, financing, building and operating mines. The merger allows our shareholders to maintain exposure to the Copperstone Mine through a meaningful ownership stake in the combined company while gaining exposure to a solid portfolio of producing and near-producing assets. We are convinced that combining forces with Minera Alamos will unlock significant value for all shareholders, as Minera Alamos is well positioned to build itself into a mid-tier gold producer. Today represents a significant milestone for all Sabre stakeholders and I would like to thank them for their support over the years.”

Benefits to Minera Alamos Shareholders

- Acquisition of a low capital intensity former gold producing project in a Tier 1 jurisdiction which complements the Company’s existing profile of late-stage development assets and the Santana gold mine.

- The current PEA (2023) for the Copperstone project envisions a near-term low capex start-up scenario capable of producing +40,000 ounces of gold per year at an All-In Sustaining Cost (AISC) of US$1,290/oz

- Diversification of North American jurisdictional exposure with the addition of the United States to Minera Alamos’ existing Mexican project development pipeline.

- Acquisition cost of approximately US$43/oz based on 300,000 ounces of Measured and Indicated (M&I) resources and an additional 197,000 oz of Inferred resources (see table below)

- Approximate 35% increase in Minera Alamos’ total gold resource inventory to almost 1,900,000 ounces and roughly a 60% increase in estimated Measured and Indicated resources. Combined gold inventory at its’ projects will comprise, on completion of the acquisition; 499,000 oz of Measured Resources, 308,600 of Indicated Resources and 1,090,000 oz of Inferred Resources.

- Previous Copperstone project investments of +US $25 million in underground mine development (over 4,000m and two underground access portals) as well as other site infrastructure facilitating a relatively rapid construction schedule that is currently anticipated by Minera Alamos at approximately 12 months from the date a construction decision is made.

- Aligns well with Minera Alamos’ core competencies with existing in-house expertise in construction, mine development and operations – Minera Alamos is already in the process of optimizing new engineering design/plans for the project construction and is expanding its technical group to manage the increased activities. Minera Alamos expects to be able to relocate a portion of the grinding and flotation equipment that it already owns to the Copperstone project. This includes the major equipment items required for reactivation of the crushing, grinding, flotation and filtration facilities at the Copperstone site. Process plant equipment and infrastructure accounted for approximately 40% of the capital budget for restarting the project in the current 2023 PEA. The remainder of the existing equipment owned by Minera can be retained for eventual use at the Company’s permitted La Fortuna project (2018 PEA).

Benefits to Sabre Gold Shareholders

- Immediate and significant premium for Sabre Gold shareholders

- Meaningful ownership in the combined company provides continued exposure to Copperstone as well as exposure to Minera Alamos’ producing Santana mine enabling participation in the current record gold price cycle

- Diversifying exposure from a single asset developer to a project portfolio with production and several other significant late-stage gold projects

- Partnership with experienced mine operators in North America with a proven history of bringing projects into production while minimizing capital expenditures

- Increased trading liquidity, enhanced value proposition and a higher profile capital markets presence

- Supportive shareholders converting debt for equity at a discount to face-value of the debt in support of the combination which removes dilution and liquidity risk of standalone balance sheet

Transaction Details

Pursuant to the Transaction, all shares in Sabre Gold will be acquired and exchanged for 0.693 Minera Alamos common shares (“Minera Alamos Shares“) resulting in the issuance of approximately 76.5 M Minera Alamos Shares after taking into account the Settlement Agreements (defined below). Prior to the closing of the Transaction, certain related party creditors of Sabre Gold (the "Creditors") have agreed to enter into a series of debt settlement agreements (the "Settlement Agreements") whereby the Creditors will receive Sabre Gold Shares at a discount (15%) to the face value of the debt. These debt settlement arrangements will clear all of Sabre Gold’s existing long-term debt obligations as well as some of its short-term debt prior to the acquisition. As a result of the exchange of the Sabre Gold shares received under the Settlement Agreements pursuant to the Transaction, the Debt Settlement would result in the issuance of approximately 21.1 M Minera Alamos Shares to the Creditors in addition to the 55.4 M issued to the Sabre equity holders.

Upon completion of the arms length Transaction and taking into account the Settlement Agreements, existing Minera Alamos and Sabre Gold shareholders will own approximately 86% and 14% of Minera Alamos, respectively. There are no Finders Fees payable pursuant to the transaction,

The Transaction will be completed pursuant to a court-approved plan of arrangement under the Canada Business Corporations Act. The consummation of the Transaction is subject to a number of conditions customary to transactions of this nature, including, among others, the adoption of a resolution approving the Transaction at a special meeting of Sabre Gold shareholders (the "Meeting") by: (i) at least 66⅔% of votes cast by Sabre Gold shareholders present in person or represented by proxy at the Meeting; and (ii) a majority of the votes cast by Sabre Gold shareholders present in person or represented by proxy at the Meeting, excluding votes attached to Sabre Gold Shares held by TOMC, Braydon and their respective affiliates (see Debt Settlement Agreements) and any other person as required under Multilateral Instrument 61-101 – Protection of Minority security Holders in Special Transactions ("MI 61-101").

Sabre expects to hold the Meeting in January 2025 and the Transaction is expected to close shortly thereafter, subject to court approvals and other customary closing conditions. In addition to shareholder and court approvals, the Transaction is also subject to, among other things, obtaining customary regulatory approvals including applicable court and stock exchange approvals, completion of the Debt Settlements and certain amendments to Sabre’s existing gold purchase and sale agreement with Star Royalties.

Further details regarding the terms and conditions of the Transaction are set out in the Agreement, which will be publicly filed by Sabre and Minera Alamos under their respective SEDAR+ profiles at www.sedarplus.ca. Additional information regarding the terms of the Agreement, the background of the Transaction and the independent valuation and fairness opinion will be provided in the information circular for the Meeting, which will also be filed on Sabre’s SEDAR+ profile at www.sedarplus.ca.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Copperstone Project Overview

The Copperstone project encompasses approximately 3700 hectares of surface area and mineral rights in La Paz County, Arizona. The project is wholly held by Sabre Gold, which controls the 546 federal unpatented mining claims pursuant to long-term lease agreements.

Prior production at Copperstone included open pit mining with 2,500 tpd of combined whole ore and heap leaching from 1987 to 1993 resulting in total reported production of 514,000 ounces of gold from 5,600,000 tons of ore grading 0.089 oz/t (2.8 g/t) of gold. In 2011, a 450 tpd floatation mill was built on site and in 2012 underground mining commenced from two declines that were previously developed in the bottom of the open pit. Operations took place from January 2012 to July 2013 until production was suspended in a declining gold price environment.

The recent, 2023 Preliminary Economic Assessment (PEA) provides a revised start-up mine plan (initial 6 years of production) for the Copperstone project, including revised resource estimates, as well as alternative mining methods, mining dilution and recovery assumptions.

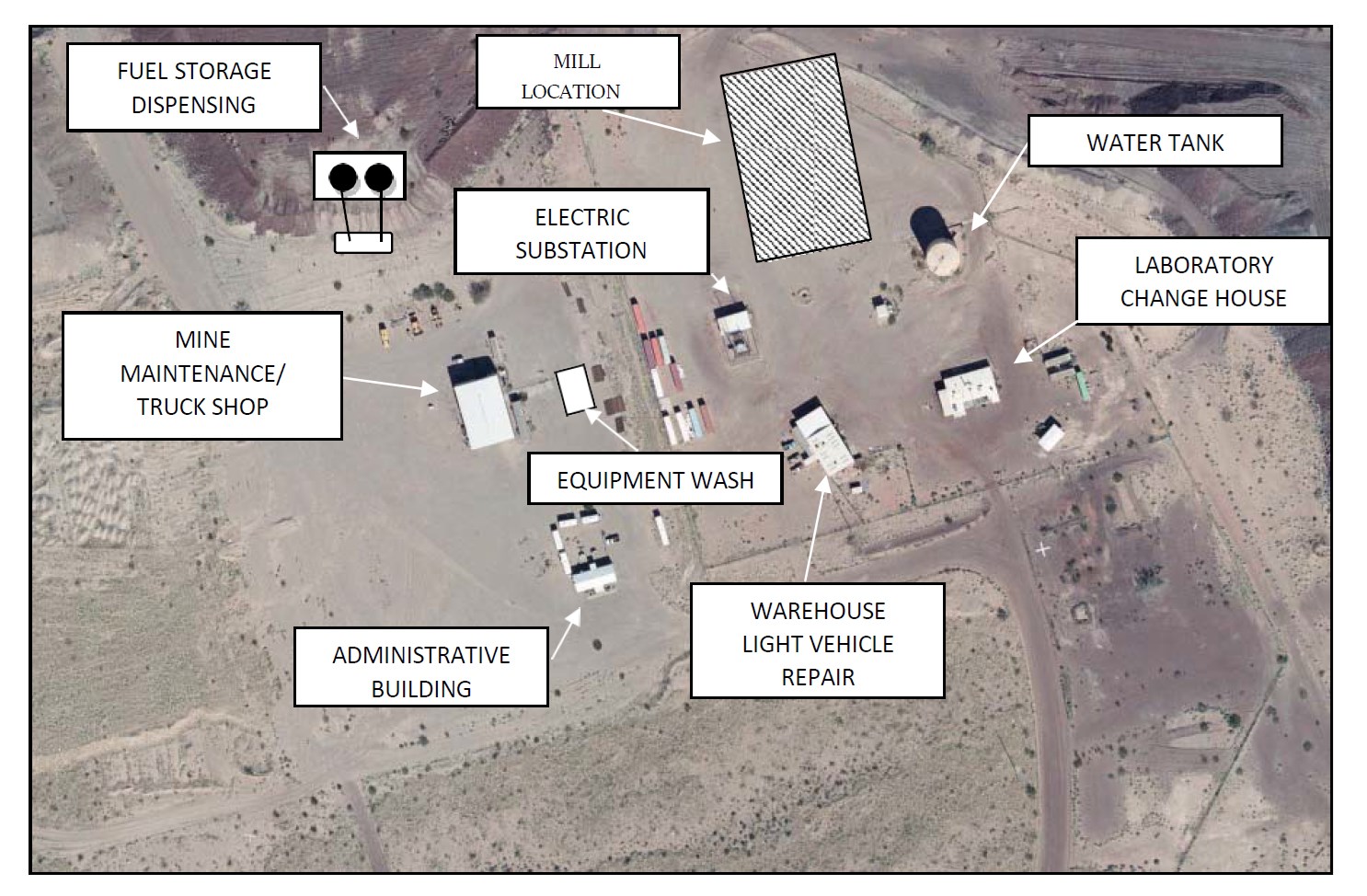

Significant site infrastructure, such as pre-existing tailings, surface facilities, utilities at site (power and water) and rehabilitated underground development will allow for reduced upfront construction cost and low initial capital per payable gold ounce to be produced over the life of the mine. A significant portion of the existing on-site infrastructure is in good repair and is available for the restart of site operations.

Permitting for the restart of mining operations is in place and required water and surface rights have been in place for years. All facilities envisioned in the current PEA are located in “brownfields” locations such that no new surface disturbances are anticipated. Modifications required for the revised mine plan and flowsheet as a result of the PEA are at an advanced stage and will be addressed in the coming months as project finance discussions are finalized.

Image – Plant infrastructure (mine access located immediately north of photo area) – Source: Sabre Gold PEA

2023 PEA Summary (all numbers in US Dollars)

| Gold Price |

$1,800/oz Au |

$2,000/oz Au |

|

After-tax NPV (5%) |

$61.8 million |

$89.3 million |

|

After-tax IRR |

50.5% |

71.1% |

|

Payback Period |

1.8 years |

1.3 years |

|

Initial Capital |

$36.3 million |

$36.3 million |

|

Sustaining Capital |

$52.1 million |

$52.1 million |

|

Average Annual Payable Gold Production |

40k oz |

40k oz |

|

Initial Mine Life |

5.7 years |

5.7 years |

|

LOM Cash Cost per oz gold payable |

$1,012 |

$1,031 |

|

LOM All-in sustaining per oz gold payable (“AISC”) |

$1,286 |

$1,305 |

|

Pre-tax cumulative undiscounted free cash flow |

$89.8 million |

$131.1 million |

|

After-tax cumulative undiscounted free cash flow |

$86.8 million |

$121.7 million |

The full report, “National Instrument 43-101 Technical Report: Preliminary Economic Assessment for the Copperstone Project, La Paz County, Arizona, USA (June 26, 2023) authored by J.J. Brown P.G. et al is available for download from Sabre Gold’s SEDARPlus profile or on their website at https://www.sabre.gold/sabre-gold/Copperstone_PEA_43-101.pdf

Darren Koningen, P. Eng., Minera Alamos’ CEO has reviewed the Sabre Gold technical report. To the best Minera Alamos’ knowledge, information, and belief, there is no new material scientific or technical information that would make the disclosure of the mineral resources included in that technical report inaccurate or misleading.

The Copperstone deposit appears to be a mid-Tertiary, detachment fault related gold deposit with mineralization distributed in relation to a northwest trending shallow angle fault and shear zone. Mineralized structures are not confined to any lithological unit, although the majority is hosted in quartz latite porphyry. In total, approximately 160,000 m of drilling were incorporated into the Copperstone resource estimate (see below) over a strike length of approximately 1200 m and to a depth of 350 m below surface.

A number of additional targets have been identified for follow-up exploration in areas outside of the current resources where significant gold mineralization has been encountered. These include deep extensions to the currently planned mining areas as well as potential strike extensions in both directions laterally from the planned mining areas and parallel gold mineralized zones.

2023 Copperstone Resource Estimate

| Category |

Tonnes |

Au (g/t) |

Au (koz) |

|

Measured |

750,000 |

8.12 |

196,000 |

|

Indicated |

457,000 |

7.09 |

104,000 |

|

Measured & Indicated |

1,207,000 |

7.74 |

300,000 |

|

Inferred |

970,000 |

6.30 |

197,000 |

- Mineral Resources have an effective date of February 15, 2023. The Qualified Person responsible for the Mineral Resource estimate is Mr. Richard A. Schwering, P.G., SME-RM, an employee of Hard Rock Consulting, LLC.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Inferred mineral resources are that part of a mineral resource for which the grade or quality are estimated on the basis of limited geological evidence and sampling. Inferred mineral resources do not have demonstrated economic viability and may not be converted to a mineral reserve. It is reasonably expected that the majority of Inferred mineral resources could be upgraded to Indicated mineral resources with continued exploration.

- The mineral resource is reported at an underground mining cut-off of 0.092 oz/ton (3.15 g/t) Au beneath the historic open pit and within coherent wireframe models, and for estimated blocks which meet the criteria of a minable shape. The cut-off is based on the following assumptions: a gold price of $1,800/oz; assumed mining cost of $90/ton ($99.21/tonne), process costs of $47/ton ($51.81/tonne), general and administrative and property/severance tax costs of $15.00/ton ($16.53/tonne), refining and shipping costs of $12.00/oz, a metallurgical recovery for gold of 95%, and a 3.0% gross royalty.

- Rounding may result in apparent differences when summing tonnes, grade and contained metal content. Tonnage and grade measurements are in Metric units. Contained metal is reported as troy ounces.

Board of Directors’ Recommendation

The Transaction has been unanimously approved by the boards of directors of Minera Alamos and Sabre Gold including, in the case of Sabre Gold, following the recommendation of the independent member of the special committee (the "Sabre Gold Special Committee"). The Sabre Gold board of directors is unanimously recommending that Sabre Gold shareholders vote in favour of the Transaction.

Prior to entering into the Agreement, the Sabre Gold Special Committee (comprised of an independent director), with the assistance of its financial and legal advisors, assessed the relative benefits and risks of various alternatives to the Transaction and Sabre’s Board determined that the Transaction was in the best interests of Sabre. The Sabre Gold Special Committee retained Evans & Evans, Inc. ("Evans & Evans") as an independent valuator to prepare a formal valuation (the “Valuation”) of the Sabre Gold Shares pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions. Evans & Evans delivered an oral opinion to the Sabre Gold Special Committee that, as of September 30, 2024 and subject to the assumptions, limitations and qualifications to be set forth in Evans & Evans’ written Valuation, the fair value per Sabre Gold Share before completion of the Debt Settlements and assuming completion of the Debt Settlements is in the range of C$0.18 to C$0.20 and C$0.20 to C$0.21 respectively.

Maxit Capital LP (“Maxit Capital”), financial advisor to Sabre Gold, has provided a verbal opinion to the Sabre Gold board of directors stating that, and based upon and subject to the assumptions, limitations, and qualifications set forth therein, the consideration to be received pursuant to the Transaction is fair, from a financial point of view, to the Sabre Gold shareholders.

Voting Support Agreements

There is strong support in favour of the Transaction from Sabre’s significant shareholders as well as the directors and officers of Sabre. All Sabre Gold directors, executive officers and certain shareholders (the “Supporting Shareholders“), collectively representing 29.6% of the Sabre Gold Shares have entered into voting support agreements with Minera Alamos, agreeing to, among other things, vote their Sabre Gold Shares in favour of the Transaction.

Debt Settlement Agreements

In connection with the Transaction, Sabre has entered into debt settlement agreements with each of Trans Oceanic Mineral Company Limited (“TOMC“), Braydon Capital Corporation (“Braydon“) and Star Royalties Ltd. (“Star“), providing for the settlement of certain outstanding debt and other obligations in exchange for an aggregate of 30,485,883 Sabre Gold Shares.

Pursuant to the debt settlement agreement between Sabre Gold and TOMC, TOMC has agreed to settle an aggregate of US$3,130,943 in principal and interest outstanding under (i) an amended and restated promissory note dated August 22, 2016 issued by the Corporation to TOMC in the principal amount of US$2,054,570, as amended and (ii) an amended and restated (convertible) grid promissory note dated August 22, 2016 issued by Sabre to TOMC in the maximum principal amount of US$1,000,000, with an initial principal amount of US$1,000,000, as amended, in exchange for an aggregate of 13,979,401 Sabre Gold Shares at a deemed price of $0.3108 per share (the “TOMC Debt Settlement“).

Pursuant to the debt settlement agreement between Sabre Gold and Braydon, Braydon has agreed to settle an aggregate of $3,131,769 in principal and interest outstanding under an amended and restated promissory note dated August 22, 2016 issued by Sabre to Braydon in the maximum principal amount of C$5,000,000, with current principal amount of $2,787,369, as amended, in exchange for an aggregate of 10,076,476 Sabre Gold Shares at a deemed price of $0.3108 per share (the “Braydon Debt Settlement“).

Pursuant to the debt settlement agreement between Sabre Gold and Star, Star has agreed to settle an aggregate of $2,000,000 payable by Sabre to Star pursuant to a restructuring agreement dated October 31, 2023 among Sabre, Star, TOMC, Braydon, American Bonanza and Bonanza Explorations, as amended, in exchange for an aggregate of 6,435,006 Sabre Gold Shares at a deemed price of $0.3108 per share (the “Star Debt Settlement” and together with the TOMC Debt Settlement and the Bradyon Debt Settlement, the “Debt Settlements“).

The TOMC Debt Settlement and Braydon Debt Settlement constitute related party transactions within the meaning of MI 61-101, as each of TOMC and Braydon is a company owned and controlled by a director of Sabre. The completion of the Debt Settlements is subject to a number of customary conditions including the approval of the TSX. The TOMC Debt Settlements and the Braydon Debt Settlement will also require the adoption of a resolution approving such Debt Settlements at the Meeting by a majority of the votes cast by Sabre Gold shareholders present in person or represented by proxy at the Meeting, excluding votes attached to Sabre Gold Shares held by TOMC, Braydon and their respective affiliates and any other person as required under Multilateral Instrument 61-101 and the rules of the TSX.

The Sabre Gold Special Committee also considered the Debt Settlements. The Sabre Gold Special Committee determined that the Debt Settlements were in the best interests of Sabre as the obligations are being settled at a 15% discount to their face value and the Debt Settlements were an essential component of the negotiations that lead to the Transaction.

The Sabre Board (excluding Mr. Fahad al Tamini, Claudio Ciavarella and Tony Lesiak, who recused themselves from voting on the TOMC Debt Settlement, the Braydon Debt Settlement and the Star Debt Settlement, respectively, as a result of their potential conflict of interest in the respective transactions), following due consideration and receipt of the recommendation of the Special Committee who unanimously approved the each of the Debt Settlements and recommended that Sabre Gold shareholders vote in favour of the Debt Settlements.

Advisors

Gowling WLG (Canada) LLP is acting as Minera Alamos’ legal advisor.

Maxit Capital is acting as financial advisor to Sabre Gold and Evans & Evans has been retained as an independent valuator. Peterson McVicar LLP is acting as Sabre Gold’s legal advisor.

About Minera Alamos

Minera Alamos is a gold production and development company. Minera Alamos has a portfolio of high quality Mexican assets, including the 100%-owned Santana open-pit, heap-leach mine in Sonora that is currently going through the start-up of operations at the new Nicho Main deposit. The 100%-owned Cerro de Oro oxide gold project in northern Zacatecas has considerable past drilling and metallurgical work completed and the proposed mining project is currently being guided through the permitting process by Minera Alamos’ permitting consultants. The La Fortuna open pit gold project in Durango (100%-owned) has a positive, robust preliminary economic assessment (PEA) completed, and the main Federal permits are in place. Minera Alamos is built around its operating team that together brought three open pit heap leach gold mines into successful production in Mexico over the last 14 years.

Minera Alamos’ strategy is to develop very low capex assets while expanding the projects’ resources and continuing to pursue complementary strategic acquisitions.

About Sabre Gold

Sabre Gold is a near-term gold producer in North America which holds 100% interest of the fully licensed and permitted Copperstone gold mine located in Arizona, United States. Sabre Gold has intended to restart production at Copperstone in the near term.

Copperstone has approximately 196,000 ounces of gold of Measured Resources, 104,000 oz of Indicated Resource, and approximately 197,000 ounces of gold in the Inferred category. Additionally, Copperstone has considerable existing operational infrastructure as well as significant exploration upside. Sabre Gold is led by an experienced team of mining professionals with backgrounds in exploration, mine building and operations.

Technical Information

Darren Koningen, P. Eng., Minera Alamos’ CEO, has reviewed and approved the scientific and technical information regarding Minera Alamos and its projects contained in this news release. Darren Koningen is a Qualified Person within the meaning of Canadian Securities Administrator’s National Instrument 43-101 ("NI 43-101").

Michael Maslowski, CPG, Sabre Gold’s COO, has reviewed and approved the scientific and technical information regarding Sabre Gold and its projects contained in this news release. Michael Maslowski is a Qualified Person within the meaning of NI 43-101.

For further information, please contact:

|

Minera Alamos Doug Ramshaw, President Tel: 604-600-4423 Email: dramshaw@mineraalamos.com Victoria Vargas de Szarzynski, VP Investor Relations |

Sabre Gold |

Cautionary Note – Forward Looking Statements

This news release contains certain “forward-looking information” and “forward-looking statements”, as such terms are defined under applicable securities laws (collectively, “forward-looking statements”). Forward-looking statements can be identified by the use of words and phrases such as “plans”, “expects” ,”is expected”, “budget”, “scheduled,” “estimates”, “forecasts”, “intends”, “anticipates” or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements herein include, but are not limited to, the expected benefits of the Arrangement, statements with respect to the consummation and timing of the Transaction; approval by Sabre Gold’s shareholders; the satisfaction of the conditions precedent of the Transaction; timing, receipt and anticipated effects of court, regulatory and other consents and approvals and the strengths, characteristics and potential of the Transaction. These forward-looking statements are based on current expectations and are subject to known and unknown risks, uncertainties and other factors, many of which are beyond Minera Alamos’ ability to predict or control and could cause actual results to differ materially from those contained in the forward-looking statements. Specific reference is made to Minera Alamos’ most recent annual management discussion and analysis on file with certain Canadian provincial securities regulatory authorities for a discussion of some of the factors underlying forward-looking statements, which include, without limitation, volatility in the prices of gold, changes in debt and equity markets, the uncertainties involved in interpreting geological data, increases in costs, environmental compliance and changes in environmental legislation and regulation, interest rate and exchange rate fluctuations, general economic conditions and other risks involved in the mineral exploration and development industry. Readers are cautioned that the foregoing list of factors is not exhaustive of the factors that may affect the forward-looking statements.

All forward-looking statements herein are qualified by this cautionary statement. Accordingly, readers should not place undue reliance on forward-looking statements. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements whether as a result of new information or future events or otherwise, except as may be required by law. If the Company does update one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements.

This press release includes market, industry and economic data which was obtained from publicly available sources and other sources believed by the Corporation to be true. Although Minera Alamos believes it to be reliable, it has not independently verified any of the data from third party sources referred to in this press release, or analyzed or verified the underlying reports relied upon or referred to by such sources, or ascertained the underlying economic and other assumptions relied upon by such sources. Minera Alamos believes that its market, industry and economic data is accurate and that its estimates and assumptions are reasonable, but there can be no assurance as to the accuracy or completeness thereof. The accuracy and completeness of the market, industry and economic data used throughout this presentation are not guaranteed and Minera Alamos does not make any representation as to the accuracy or completeness of such information.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.